After some investigation into SME CRM Nimble and Freshsales and travel management software traform today is the day of a reflection on customer orientation in one of the industries that managed to become almost indispensable in our lives.

Banks.

So let me tell you ...

A Bank Tale of Mystery and Imagination

But not an invented one. This is life in 2016.

Imagine the following extremely uncommon scenario: You want a mortgage for a house. Imagine also that you have a fairly good income, so you want to pay down fast. After all interest rates in NZ are still pretty high compared to other developed nations – although they are very low for NZ standards. And remember – one of the basic premises of neoliberalism is that everybody has equal negotiation powers (the Kiwi in me says “Yeah, right” to that one …).

What are the variables you have in a mortgage? The total amount, interest rate, pay down period, term of fixing the interest rate, unless you go floating, that is, and the start of the pay down.

So you start doing some maths on what you are able and willing to regularly pay and start negotiating a rate, finally coming to an agreement, clearly communicating that you want a fixed term of one year, and a calculated pay down period of, say 10 years, and weekly payments.

You are happy.

The documentation arrives, actually three pieces of it.

- A summary of the agreement

- Terms and Conditions on about 30 pages of legalese. No need to go through it here; it basically details out that the bank has all rights and you none.

- A third document that tells you that the bank is so happy to do business with you that they give you a cash incentive of 1% of the mortgage amount. Nice, but why not reducing it from the interest rate, thus faster reducing the principal – or improving your cash flow by making ongoing payments smaller? After all this money goes directly away from their income in the year of fixed interest. Do some maths by reducing it off the accumulated interest of the one-year contract period or only off the principal that remains after one year. Observe the interest rates. You will be amazed.

There is only one reason for doing it this way: Bind the customer for longer using a clause in the incentive document (yeah, there it is: a multiyear condition …) and now the bank nicely gets this returned in multiples as the higher interest rate leaves you with a higher remaining principal after the year, means more interest for them … Of course you can put the money onto a savings account and take it off the money you need next year – but I deviate.

Try negotiating this ‘incentive’ into the interest rate and let me know the outcome.

Now you look into your main parameters:

Amount: Check.

Interest rate: Check. But what is this repetitive statement about the interest rate might change, formulated in a way that it might change even during the fix period (of one year, as we assume so far)? Hhmm, confusion.

Fixing period: 2 years? Oops, didn’t we say 1?

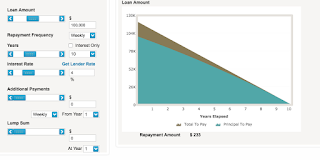

Calculated pay down period: 30 years! Yes, THIRTY. Assuming 4 per cent of interest and a $ 100,000 mortgage this makes an accumulated interest of $ 71,869 as opposed to $ 21,494. This is a bit of a difference.

Payment period: Every two weeks.

Payment start: 3 weeks after start of the mortgage. Hhhmm, you didn’t say anything about that but there is no reason for you to wait with the payment start, right?

Well, at least the bank got one parameter right.

But still, you feel somewhat cheated upon.

The remaining question is whether these errors are genuine or part of a method. After all, nearly every single parameter was wrong in favor of the bank. Even the seemingly generous incentive is built in a way that it is least beneficial to you.

I learn two lessons from this tale:

- Obviously: Read what you sign. It might not be what you expect

- Even in the best case this shows that banks care more about securing their income than about the customer. Although this is a short sighted position, because experiences like this are shared. And this erodes the same income that shall get protected

Of course, some phone calls later all the parameters are fixed. But still, a bad taste remains …

So, what could be different?

On the outset this is blatantly obvious: Deliver documentation as per the agreement. As said, in the best case this failure shows poor process. The worst case is, well, worse …

In our scenario there was one variable (the start of the payment) untreated. As a perhaps unexperienced borrower you might not always think of it, as a bank you probably should have asked, not assumed something. Again, poor process, or …

While it is understandable that banks try to protect their business it does not show good faith to attempt a lock in of the customer or to attach 30+ pages of terms and conditions to a simple thing as a mortgage. The lock in happens via tying ‘incentives’ to longer term conditions or asking for securities that are far in excess of the value of the mortgaged property. This is simply to make it harder to change to the competition whereas the better way would just be to be better, easier to deal with, and continuing to have the overall better package.

Part of this could be limiting the terms and conditions to something that the average customer can easily understand in a short time. This can be done. A mortgage broker who is a friend of mine tells me that there is a bank around that has terms limited to three pages only, with the offer summary being a one-pager.

The Bottom Line

All this boils down to customer orientation rather than product orientation. Starting with an outside-in view rather than an inside-out one would help to easier contribute to the customer’s job-to-be-done while reducing internal process cost. This will make the customer want to return without the need for tying him/her via clauses.

Part of this is a continuing digital transformation but most importantly there is a need for a culture change. There are new fintech companies emerging left, right, and center that address these issues and threaten to disrupt the banks’ business.

Time to think.

And act.

Comments

Post a Comment