|

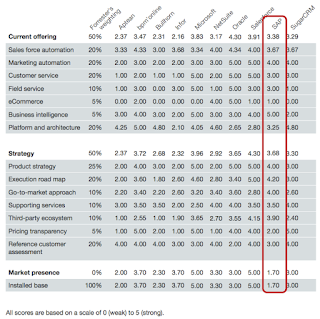

| Source: Forrester Wave CRM Suites for Mid-Sized Businesses Q4/16 |

Finally,

the much-anticipated Forrester Wave on CRM Suites for Mid-Sized Businesses Q4/2016

has been published by Kate Leggett

and her team at Forrester Research.

Besides the

usual suspects Oracle, Microsoft, Salesforce, and SAP it covers 7 more vendors

that fulfil Forrester’s definition of a CRM suite for mid-sized businesses.

This

definition roughly is

· To be considered a suite the

software covers at least three of the CRM disciplines

o

Marketing

o

Sales

Force Automation

o

Customer

Service

o

Field

Service

o

E-Commerce

o

Customer

Analytics

· There needs to be prebuilt

integration between the products, if they are not within the same system;

integration shall be via open standards to allow for integrating other

applications.

· The software needs to be targeted at

organizations between 250 and 999 employees.

· Multiple industries need to be

targeted.

Of course,

the solutions need to be in active use and there need to be customer

references.

The

Forrester Wave has some interesting results, some confirming what other people

see, too, others somewhat surprising.

|

| Source: Forrester Wave CRM Suites for Mid-Sized Businesses Q4/16 |

Let me

start with the confirmations, continue with bits that surprised me, and close

with an SAP specific view.

The Confirmations

Of course,

we are talking cloud – cloud and nothing else.

As can be expected

all vendors strive to deliver a toolset that helps their customers to deliver

consistent customer experiences. Now I, and others, would argue that the

experience is largely in the realm of the end customer and the users and that

there is nothing like a ‘system of experience’. Delivering consistent

experiences encompasses far more than a CRM suite. But then it is far easier

(and sexier) to talk about delivering experiences than about systems of record

and engagement that help in giving customers a great experience.

The CRM

landscape has just exploded, yet is quite mature – which sounds like a

contradiction in itself, but just shows the power of the cloud and modern

architectures – in particular micro services – to drive innovation. Despite

lots of consolidation going on in parallel, too, there are suites targeting

different sizes of organizations, different industries. All of them deliver

different breadth and width of functionality. Then there are plenty of

best-of-breed vendors that may or may not commit to one of the major platforms;

some of them may or may not be viable, or might just get acquired. In essence, smaller

vendors try to eat the bigger vendors’ lunches and to push the contenders

upmarket by providing good point solutions with great user interfaces. The

contenders are responding by increased modularization, with acquiring

functionalities they need to close their functional gaps, and with an ecosystem/platform

play.

The ‘Triple

I’ of Integration, Industry, Intelligence finally becomes key. To me it has

been obvious for more than a decade but the concept now gets real traction. Integration

and intelligence because of advances in technology, industry due to a

realization that no one can be everything for everyone; this only bloats the

systems and ultimately makes them clunky, expensive, and unmaintainable.

Finally, it

is no surprise that the big 4 show up as leaders. Oracle, Microsoft and

Salesforce are currently a given, and SAP worked hard on their strategy, messaging

and delivery. Since 2016 they in my opinion have a very competitive solution

set with their Hybris branded products. Salesforce still leads the pack but

will feel some real challenge by Microsoft if they get their marketing

functionality sorted and finally offered an integrated e-commerce solution. The

latter could be a real push. Ah, yes, an improved pricing engine couldn’t harm,

either – but that holds true for Salesforce, too.

The Surprises

Yes, there

are a few. Starting with bpm’online. I wouldn’t have expected to see them as a

leader, but apparently, they have significant strength in SFA and their

platform, combined with transparent pricing and very happy customers.

Congratulations. Build on these strengths, work on some of the perceived ‘weaknesses’

– I’d recommend e-commerce, marketing, and customer service to start with.

Pegasystems

is not in. OK, looks like their client base is a bit too far on the Enterprise

side.

SAP has a

low score in e-commerce. What? Given Hybris being one of the strongest

e-commerce solutions around, this is a bit of a surprise. Let me resolve this

conundrum in the SAP section.

What this means for SAP

Welcome

back amongst the leaders! This is long overdue, but SAP’s absence as a leader

was largely self-inflicted. Poor strategy, poor messaging, poor products.

Finally, this changed.

But why the

low marks in the e-commerce section? The devil is in the detail. Forrester sees

only a loose coupling of e-commerce to the rest of the suite. Hybris Commerce

essentially is still seen as a standalone product that can be plugged into the

CRM landscape. This, besides being a challenge for in-depth integration also

leads to user experience challenges and a few product inconsistencies like

having customer service functionality in Hybris Commerce as well as in Hybris Cloud

for Service. But again, Hybris Commerce is one of the strongest e-commerce

solutions around.

Then there

are some smaller tidbits, which are mainly around Field Service, platform, and

pricing – with the latter being a recurring, eternal topic. Increased pricing

transparency would be a real boon. Regarding field service and platform SAP

seems to be on a good way with the release of SAP HANA 2 and ongoing work in

what SAP calls the high touch service area.

In closing,

for SAP this Forrester Wave marks both, a success, and a little setback. The

success lies in them having managed to make it back into the leaderboard,

albeit barely, due to them now having resolved above three issues.

The setback

lies in the fact that they haven’t been able to fully sell the integration

story between e-commerce and the rest of the Hybris branded products. While the

cloud for customer and marketing products are built on SAP HANA, Hybris

Commerce is not. This is clearly a platform gap. Furthermore, the integration between

Hybris Commerce and the other products still is limited. On the other hand

Hybris Commerce not being built on SAP HANA can help SAP to sell into non SAP

customer bases. So, I personally would not see it as much of a problem as

Forrester does. Still, some more work is clearly necessary on both ends,

technically as well as from a messaging point of view.

For more

coverage on SAP, refer to below articles.

Comments

Post a Comment