Sparked by

an article by Bob Thompson,

titled You

had me at “Treat Customers as People” about Kustomer, a new kid on the customer service

block, I ventured to reach out to founder Brad Birnbaum and his team to get

some more information. After all the customer quadrant of software is quite

crowded, and a new company needs to offer good ideas to keep up and go beyond

the incumbents, most of them being young companies as well.

One of the

basic questions that I had was: Do we need another customer service solution?

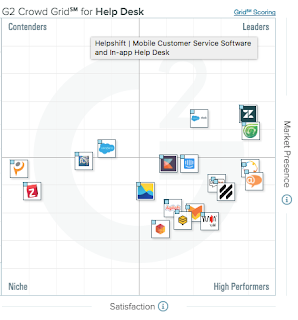

After all, G2Crowd already lists 19 in

their Help Desk grid;

and these are only the ones that made it into the grid. Overall G2Crowd counts

78 solutions, excluding Kustomer.

And quite

some of them are quite strong.

|

| G2Crowd Grid for Help Desks as of December 2016 |

Brad and his team certainly seem to be of the opinion that there is an unmet need; as are their investors who brought in $ 12.5 million into seed- and series A funding in less than a year. The founders bring experience that dates back to 1996 and includes the success of Assistly, now desk.com, which is part of Salesforce.

Another question is: How does Kustomer want to differentiate

itself or, which issue do they solve that the other companies do not yet solve.

Quite simply put, Kustomer claims that there are too many unconnected point

solutions that customers – and hence employees – need to deal with. This issue

gets addressed by the Kustomer platform that acts as an integration hub and

connects customer service representatives to a multitude of communications

channels; teams are enabled to ‘spend

their days building meaningful relationships with customers and quickly and

effectively solving their problems’.

To accomplish this the team has built their user interface

around the concept of the customer. Incoming support requests, regardless of

the channel, are displayed by customer and not, as in other applications, by

incident. When opening a customer all her incidents and conversations around

these incidents are displayed in one timeline. The user interface allows for

reply to the different channels. To emphasize on the focus on the customer

Kustomer offers a simple sentiment tool that shows sentiment by customer and by

conversation.

Additionally, they offer a workflow engine that allows the

automation of certain processes via configuration, as opposed to coding.

Core objects can get enhanced and additional objects can get

created – although I couldn’t test this feature, maybe due to the privacy tools

that I installed on Chrome.

My Take

I have mixed feelings here. The market is contested and

Kustomer is not an early entrant. On the other side, they managed to secure

around 20 customers in a year.

But then my opinions base on a short briefing and a brief

trial of the system. I am interested in learning more.

So much for a disclaimer at this point …

Kustomer has bold messaging, but then they have a leadership

team with plenty of experience and credibility. This is also evidenced by the

team being able to collect 12.5 million dollars in investment in less than one

year.

While arranging the inbox around the customer is different

from the incident based inbox of other systems the judge is still out whether

this is a competitive advantage or not. The distinguishing factor that I

currently see is the timeline in combination with the vision of including information from other systems, like order

tracking system, delivery status, etc. Especially, if the Kustomer team manages

to implement a way that consistently keeps track of conversations even if customers

change the communications channel and/or do not use the reply button but just

shoot off another message to an existing conversation.

This, however, would require some sophisticated text mining

and also does not necessarily make up for a lasting advantage.

The platform thought offering custom-, as well as customizable

objects, workflows and events that integrate with the inbox gives a good view

into customer interactions and behaviour once the needed objects are in place. This

can be seen by the Shopify integration. It might also be an important resource

for future enhancements of the functionality beyond customer service. I do say

this because in my eyes customer service starts well ahead of making the sales transaction

and needs to strongly consider helping towards a buying decision.

The platform approach, is nothing that we haven’t seen

before; however, most vendors aspiring a platform are looking at bigger clients

than Kustomer does. And Kustomer surely has the advantage of being able to build

upon state-of-the-art technologies and architectures where other players

already have an architecture and technology in place, which might decrease

their pace of innovation.

At this time, the team fully focuses on customer service

functionality, which is a good move as the market is very competitive, and as the

unification of communication channels into one application/user interface is

not complete enough, currently only supporting mail, a chat interface and

text/SMS. In-app mobile support, knowledge base support. While there is a

statement that customers can easily customize their setup to connect to social

media, messaging services, etc., this is functionality that should come

out-of-the box.

But then, again, Kustomer is a young platform and solution –

a lot can happen in the next months.

It will be interesting to see the market evolve.

Comments

Post a Comment